I have something in the works for here...just going to take a little bit of time.

Meantime, I've updated Alex's blog.

http://beckonedtoourknees.blogspot.com

thank ya!

Friday, June 26, 2009

Sunday, June 21, 2009

8 Things....

I'm up late babysitting tonight and while I'm really sitting here not doing a thing in the world but killing time, I thought I would post this...

My Sis-in-law, Ginger (http://www.heresmycuplord.com) tagged me on this:

8 Things..

Hey, wow, I just realized just how little I actually watch tv.

And just so you know, I have been contemplating turning off the cable. I'll let you know how that goes.

:D

My Sis-in-law, Ginger (http://www.heresmycuplord.com) tagged me on this:

8 Things..

- 8 Things I look forward to:

- Spending the day with my hubby and children to celebrate Father's Day, the first day of summer, and his birthday!

- My Dunkin' Donuts coffee every morning, made courtesy of my loving husband.

- Getting PCS'd back to Georgia in about 1 year and 1/2.

- Homeschooling Alex

- Taking Alex to the developmental pediatrician (praises be to GOD for the wisdom they will have and the answers we will receive Amen and Amen!)

- Seeing my family in Georgia on our roadtrip that is coming up soon

- Learning even more about the giftings God has blessed me with

- Having a closer and more mature relationship with Christ!

- 8 Things I did Yesterday:

- Shared coffee with the hubby!

- Studied scripture

- Created a diagram that was related to me study and hung it up on the baby's wall for quick reference!

- Change LOTS of diapers!

- Snuggled with Blythe

- Cooked dinner - and we make that a family affair!

- Prayed and prayed more!

- Spend time with God w/the worship music blasting on the radio!

- 8 Things I wish I could Do....

- Go and buy a brand new van WITH CASH right now!

- Stop smoking without going to see the doctor over it.

- Have my dental work magically done in my sleep overnight and never have to deal with it again.

- Deliver some people that are very close to me from the torment that they have been under (and this one makes me very sad....)

- Lay new sod in my yard....my baby is allergic to the grass that is out there now!

- Change the Army's mind about sending my hubby to Iraq.

- Be so much more like Jesus than where I am now (but I'm getting there Hallelujah!)

- Protect my children FOREVER.

- 8 Shows I Watch.....

- House (when it's in season)

- Hell's Kitchen (Gordon Ramsey is frightful!)

- American Idol (and that has only been a recent thing for me)

- Lie To Me (I find this show amazingly fascinating!)

- (uh oh, I'm running out so here are the ones I BARELY watch)Extreme Makeover Home Edition

- Wife Swap on ABC

- Dog Whisperer

- Animal Cops Houston

Hey, wow, I just realized just how little I actually watch tv.

And just so you know, I have been contemplating turning off the cable. I'll let you know how that goes.

:D

Tuesday, June 16, 2009

Money Monday (on a Tuesday Night LOL)

I realize that this is a late post, but please extend grace...My household gets very hectic sometimes and well, to be honest yesterday was a "day of days" in which Mommy decided it was time for some housecleaning....so the kitchen was redone and scrubbed down, the living room was completely changed - including moving the furniture around. Kids LOVE all the space and so do I. I moved my chaise lounge out from in front of the television for peace! I never watch it anyway, so I'm not missing much!

So onward with the task at hand!

I read somewhere about your personal money tree. You know, the kind that our parents you to refer to when they would say, "What, do you see a money tree in the back yard?" Actually, we all have a "money tree". It's called our paychecks. And really, how you "water" your tree will not only determine the tree's vitality, but also the fruit of that tree.

For example, if you save your money, invest wisely, then you are "watering" your tree with good water, and it will produce good fruit. However, if you water your tree with more and more debt, well needless to say your tree will eventually shrivel up and die.

We were there. We had soo much debt it was unreal. We had the kind of debt that we could not even buy groceries for our household for all the bills we had to pay. We chose to buy groceries, of course, but then we ran into the problem of not being able to pay bills. A bankruptcy and several several collections accounts later we are still struggling to recover from those poor choices. We don't have that massive amount of debt any longer, but we most certainly have to deal with the consequences of unwise choices and money MISmanagement!

The method we chose to get out of debt is the "tier method" or "pyramid method". It worked for us. Most people will tell you to pay off what is costing you the most interest, and while that advice works for alot of people, for a good majority of others it is not something feasable.

We looked at all of our bills. We took the one we owed the LEAST on, and paid it off first. Then we got the next one. We would pay our normal payment on the account, PLUS what we used to pay of the first account. That can take time, but it is much easier to handle if you are at the place where you are struggling to even put milk on the table.

Another trick you can utilize is with your federal withholdings. You CAN for A SHORT AMOUNT OF TIME, claim as many exemptions as allowed by law. That will allow you to get in your max amount of money to help your get your head out of the water and put you at a place where you are not drowning. However, REMEMBER that is something that can only be done for 4-6 months (depending on your exemption claim). After that, you are going to end up paying the IRS ALOT of money so make sure you change it back.

For example, we claimed married w/6 on his pay. That freed up a lot of his income. We actually did it for the whole year. The reason we were able to do that is simply that is our current exemptions and when we file at the end of the year that is what we claim. Now don't get me wrong, I think we only got back like $3k that year, but during the year that extra money was a HUGE blessing for us.

Hopefully this will give you even more ideas when you are looking at your own financial situation. I really pray that each and every person that reads this, examines what God is speaking to them about their finances, and just commits to being a good steward with money and really gets ahead!

Blessings inward are blessings that you can pour outward!

So onward with the task at hand!

I read somewhere about your personal money tree. You know, the kind that our parents you to refer to when they would say, "What, do you see a money tree in the back yard?" Actually, we all have a "money tree". It's called our paychecks. And really, how you "water" your tree will not only determine the tree's vitality, but also the fruit of that tree.

For example, if you save your money, invest wisely, then you are "watering" your tree with good water, and it will produce good fruit. However, if you water your tree with more and more debt, well needless to say your tree will eventually shrivel up and die.

We were there. We had soo much debt it was unreal. We had the kind of debt that we could not even buy groceries for our household for all the bills we had to pay. We chose to buy groceries, of course, but then we ran into the problem of not being able to pay bills. A bankruptcy and several several collections accounts later we are still struggling to recover from those poor choices. We don't have that massive amount of debt any longer, but we most certainly have to deal with the consequences of unwise choices and money MISmanagement!

The method we chose to get out of debt is the "tier method" or "pyramid method". It worked for us. Most people will tell you to pay off what is costing you the most interest, and while that advice works for alot of people, for a good majority of others it is not something feasable.

We looked at all of our bills. We took the one we owed the LEAST on, and paid it off first. Then we got the next one. We would pay our normal payment on the account, PLUS what we used to pay of the first account. That can take time, but it is much easier to handle if you are at the place where you are struggling to even put milk on the table.

Another trick you can utilize is with your federal withholdings. You CAN for A SHORT AMOUNT OF TIME, claim as many exemptions as allowed by law. That will allow you to get in your max amount of money to help your get your head out of the water and put you at a place where you are not drowning. However, REMEMBER that is something that can only be done for 4-6 months (depending on your exemption claim). After that, you are going to end up paying the IRS ALOT of money so make sure you change it back.

For example, we claimed married w/6 on his pay. That freed up a lot of his income. We actually did it for the whole year. The reason we were able to do that is simply that is our current exemptions and when we file at the end of the year that is what we claim. Now don't get me wrong, I think we only got back like $3k that year, but during the year that extra money was a HUGE blessing for us.

Hopefully this will give you even more ideas when you are looking at your own financial situation. I really pray that each and every person that reads this, examines what God is speaking to them about their finances, and just commits to being a good steward with money and really gets ahead!

Blessings inward are blessings that you can pour outward!

Wednesday, June 10, 2009

Happy Birthday Haley!

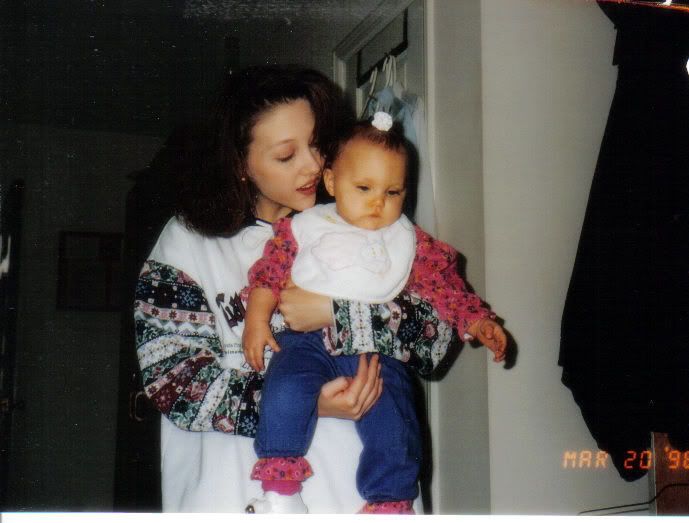

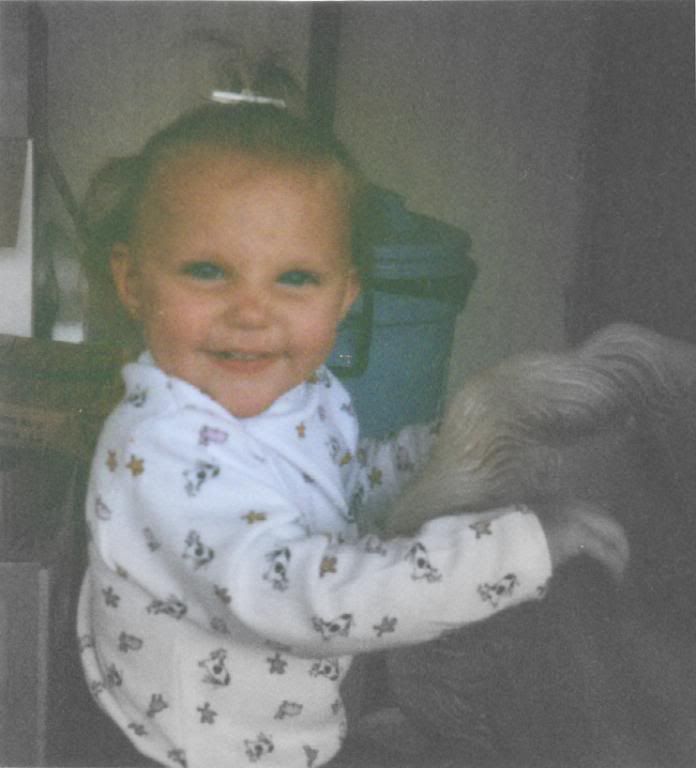

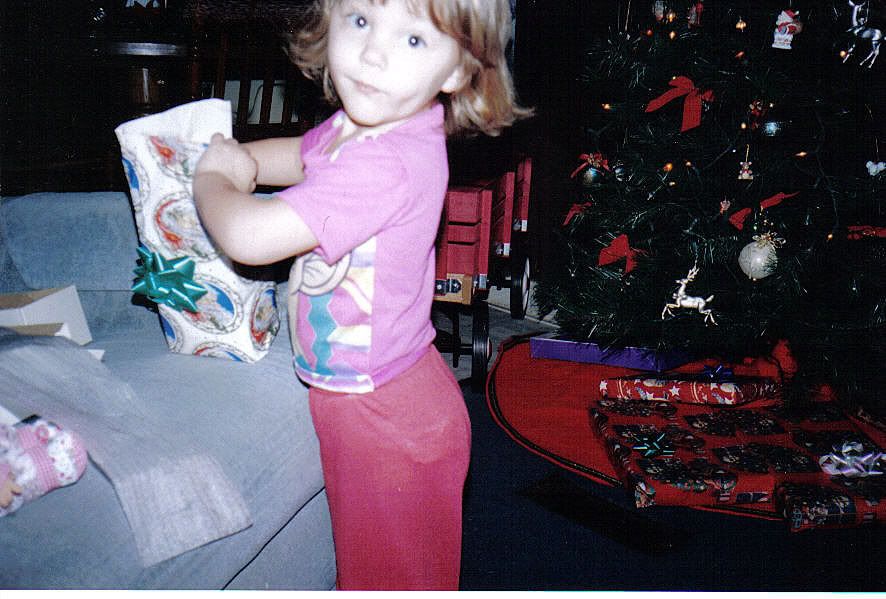

14 years ago today, at 3:28pm, God blessed me with a beautiful 6lb 90z baby girl. I named her Haley Leann.

She was a shining light into my life! Absolutely beautiful, happy, and a very loving baby. She was most certainly, a snuggle bug!

One thing is for sure, she certainly touched many lives during her time here on this world. She brought joy to many of us who felt that joy was gone, she brought a second chance to those who desperately needed it, and she brought laughter to us who needed. There is not a person who she came in contact with that was not affected by her presence, or her beautiful smile.

Yes, we miss her. Yes, we think of her every single day. I often think of how she would be today. What would her interests be? How would she do in school? What would she look like? How would her voice sound? What struggles would we have? What would be our triumphs? I try to share with her other brothers and sisters who she was - I try to impart a sense of knowing to them. She is part of our family, she is part of our history.

And yes, I mourn for the child that I cannot wrap my arms around.

However....

I still celebrate! I celebrate the life of a child that I have known, a life that I was given the opportunity to know intimately. I know that she is wrapped in the arms of Jesus, that God called her home so that she would suffer no more and from that satan was defeated on his attack on her body. Hallelujah and Praise God for knowing what I did not, and for protecting this beautiful angel!

And there I want to leave, knowing that she is perfect in her heavenly home, and today I can celebrate with the kids the birthday of their beloved sister!

Haley Leann McIntyre

June 10, 1995 - February 27, 1998

Monday, June 8, 2009

Money Modays!!! Budgets...

Oh yes, today I am approaching the dreaded "budgets". Really, why do our stomachs roll over whenever that word is mentioned? I truly believe it is because the word budget signifies restraint, accountability, and responsibility. We'll give so much over, but man oh man, when it comes to money, that is ONE area that seems to be the hardest to give to God. Could it be that we are so frightened of losing control that we are willing to hord something that does not even belong to us?

Okay. So here is the deal. The most awfulest (is that even a word lol) lamest excuse for not having a budget that I have ever heard was "I don't make enough money for a budget!" Really? Well, the LESS money you make the MORE important a budget is!

Truly budgets are important no matter what the amount is that you bring in. Again, it is one area that we must hold consistency, responsibility, and accountability. That is where we really can show that we really are "grown ups".

How you do your budget is up to you. The good thing about a budget is that you can tailor it to meet you right where you are and help you attain goals. Everyone's budget is going to be different from each other, because each household is different, each need is different. What works for one may not work for another. However, the basics of a budget are the same.

Our family lives on a budget. There are 6 of us in our household, and 1 income provider. We have to budget. And yes, I occasionally fall off of the budget. When I do, I know it. It becomes very evident very quickly. I'm not perfect about it, so please don't think that I am approaching this subject as someone who is dead on it. I make my mistakes too, but you know what? God's grace and mercy is sufficient in ALL things (and that includes my mistakes)!

1. Set a goal.

What do you want to see accomplished? It can be a long term goal (like ours is to be able to build a home for us when my hubby retires from the Army and pretty much completely pay for it out right) or it can be a short term goal (like saving for a trip in a few months). Or, you can combine goals. Like our house, we have our long term goal, but we also have a short term goal of visiting family next month so we have that added in. The point is, once you have a goal, you have a starting point.

2. Make a priority list.

This should be which bills HAVE to be paid, in order of importance. For us, it goes like this: house, utilities (power/water), car insurance. Our cable bill however, is at the bottom of the list, BEHIND groceries!

3. Stick to it!

This seems to be the hardest part. Getting everything down on paper always looks good, but sticking to it seems to be the issue. Apparently we ALL have problems with self-restraint and self-control. I'm there with you, trust me. I spent where I shouldn't have last month and we are now in a recovery phase again. The great thing about it, it gets easier for self control the more we do it!

I just really want to encourage everyone to get on a budget. You will see a marked difference in where you are financially if you do!

Next Monday I am going to blog about our money trees. Hope to see you there!

Okay. So here is the deal. The most awfulest (is that even a word lol) lamest excuse for not having a budget that I have ever heard was "I don't make enough money for a budget!" Really? Well, the LESS money you make the MORE important a budget is!

Truly budgets are important no matter what the amount is that you bring in. Again, it is one area that we must hold consistency, responsibility, and accountability. That is where we really can show that we really are "grown ups".

How you do your budget is up to you. The good thing about a budget is that you can tailor it to meet you right where you are and help you attain goals. Everyone's budget is going to be different from each other, because each household is different, each need is different. What works for one may not work for another. However, the basics of a budget are the same.

Our family lives on a budget. There are 6 of us in our household, and 1 income provider. We have to budget. And yes, I occasionally fall off of the budget. When I do, I know it. It becomes very evident very quickly. I'm not perfect about it, so please don't think that I am approaching this subject as someone who is dead on it. I make my mistakes too, but you know what? God's grace and mercy is sufficient in ALL things (and that includes my mistakes)!

1. Set a goal.

What do you want to see accomplished? It can be a long term goal (like ours is to be able to build a home for us when my hubby retires from the Army and pretty much completely pay for it out right) or it can be a short term goal (like saving for a trip in a few months). Or, you can combine goals. Like our house, we have our long term goal, but we also have a short term goal of visiting family next month so we have that added in. The point is, once you have a goal, you have a starting point.

2. Make a priority list.

This should be which bills HAVE to be paid, in order of importance. For us, it goes like this: house, utilities (power/water), car insurance. Our cable bill however, is at the bottom of the list, BEHIND groceries!

3. Stick to it!

This seems to be the hardest part. Getting everything down on paper always looks good, but sticking to it seems to be the issue. Apparently we ALL have problems with self-restraint and self-control. I'm there with you, trust me. I spent where I shouldn't have last month and we are now in a recovery phase again. The great thing about it, it gets easier for self control the more we do it!

I just really want to encourage everyone to get on a budget. You will see a marked difference in where you are financially if you do!

Next Monday I am going to blog about our money trees. Hope to see you there!

Subscribe to:

Posts (Atom)